How I started my estate and end-of-life planning

Until recently, I did not have estate and end-of-life planning in mind, but it was the natural next step in my quest to be a responsible adult, with a nudge from the existential threat of the COVID-19 pandemic.

Until recently, I did not have estate and end-of-life planning in mind, but it was the natural next step in my quest to be a responsible adult, with a nudge from the existential threat of the COVID-19 pandemic.

I paid off my car loan and credit card debt and started building an emergency fund. And I recently finished deep cleaning and decluttering my apartment Marie Kondo-style after a leave of absence and the COVID-19 lockdown kept me away from it for a year and a half.

Once you reach your mid-30s, you look at the world a little differently. When I found a book titled In Case You Get Hit by a Bus: How to Organize Your Life Now for When You’re Not Around Later. It immediately sounded like something I hadn’t known I was looking for.

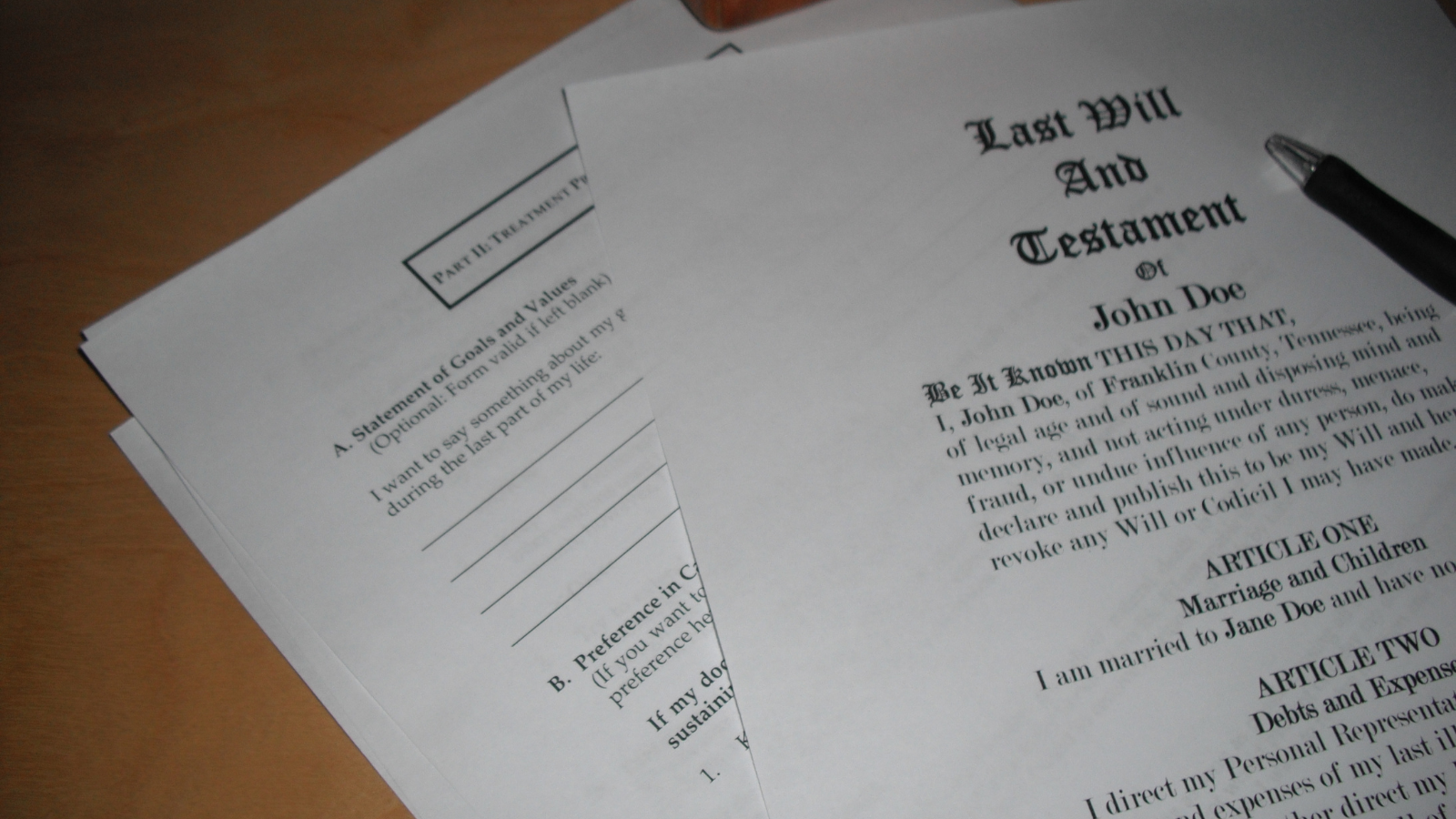

I started listening to the audiobook version, which not only got me thinking about things I knew about, such as wills and life insurance, but also things I didn’t know about, from ethical wills to long-term care insurance. It served as my blueprint for getting my life affairs in order and setting financial plans in motion this year.

The tasks recommended in the book are listed here.

I won’t run through the entire checklist of planning tasks here, but I will pass along resources for two in particular that I found helpful:

-

You can use FreeWill to create a will for…you guessed it…free.

-

And you can check out my post about advance directives with links to a dozen resources that helped me put mine together.

The federal National Institute on Aging also has a guide to getting your life affairs in order.

Photo by Ken Mayer, CC BY 2.0.

Topics

Authors

Mike Litt

Director, Consumer Campaign, U.S. PIRG Education Fund

Mike directs U.S. PIRG’s national campaign to protect consumers on Wall Street and in the financial marketplace by defending the Consumer Financial Protection Bureau, and works for stronger privacy protections and corporate accountability in the wake of the Equifax data breach. Mike lives in Washington, D.C.

Find Out More

Apple AirPods are designed to die: Here’s what you should know

New report reveals widespread presence of plastic chemicals in our food

Consumers call on Meta to protect kids’ safety in Quest virtual reality